GRADUATE CERTIFICATION

This graduate certification is equal to a MicroMasters degree in Accounting and Financial Management. Therefore, you need to complete the following four courses to receive your Graduate certification in Accounting and Financial Management:

- Financial Decision Making

- Financial Management for Corporations

- Financial Management in organizations

- Long-Term Financial Management

Each course is taken for 8 weeks.

Complete the certificate in 8 months if you invest 8-10 hours a day for each course.

The program costs $2,999 when you register to take all 4 courses successively!

But you can register and pay per course individually for $899

The credit will be counted toward your certification program that will be awarded upon the successful completion of all 4 courses.

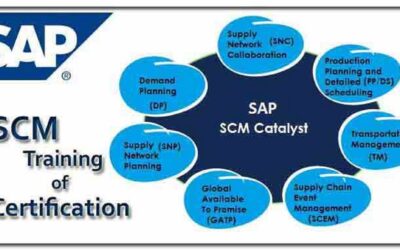

COURSE DESCRIPTION

Accounting and Financial Management prepares individuals for finance careers within organizations. Learners who successfully complete the program will be well-positioned to play active roles in the evolving future of accounting and financial management and to become trusted financial advisors and strategic decision-makers for businesses.

COURSE OVERVIEW

Are you ready to advance your career and move toward an organizational leadership position, such as a Chief Financial Officer (CFO)? Ideal for midcareer professionals, this certification equals a MicroMasters program. It will help you build the skills you’ll need to make high-level decisions that impact your organization’s current operations and financial future.

You will gain hands-on experience as you report and analyze financial transactions of corporations. Further, you will learn how to assess risks and returns of alternative investments by analyzing SEC 10-K reports of Fortune 500 companies and enhance your ability to make effective financial management decisions to prepare for future career advancement.

WHAT YOU WILL LEARN

- Manage an organization’s financial operations; including revenues, expenses, assets, liabilities, and equity.

- Evaluate alternative investments by using the time value of money calculations, and understanding their effect on cash flow.

- Perform financial analyses and modeling.

- Contribute to strategic management decision-making and operational problem-solving.

- Use case studies of real companies facing financial challenges to analyze situations, assess risks, and propose courses of action

Course Features

- Lectures 61

- Quizzes 6

- Duration 320 hours

- Skill level All levels

- Language English

- Students 45

- Assessments Yes

1 Comment

Define concussion, and traumatic brain injury Define post concussive syndrome Utilize available tools to diagnose concussion Counsel patients families on concussion management Manage patient and family expectations following concussion Recognize and manage post concussive syndrome Counsel patients and athletes on the return to learn and return to play protocol priligy buy